Until August 23, 2020 (the 25th day after the date of this prospectus), all dealers that buy, sell or trade ADSs, whether or not participating in

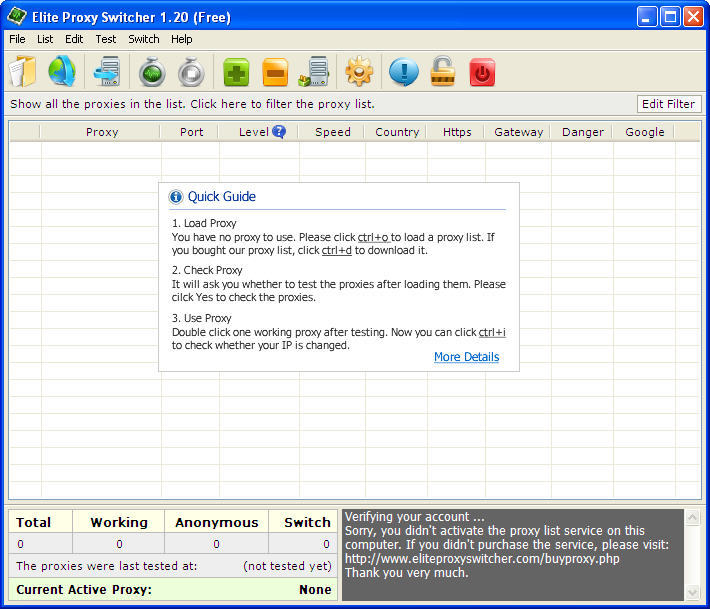

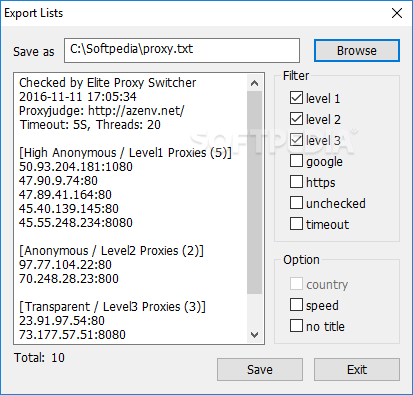

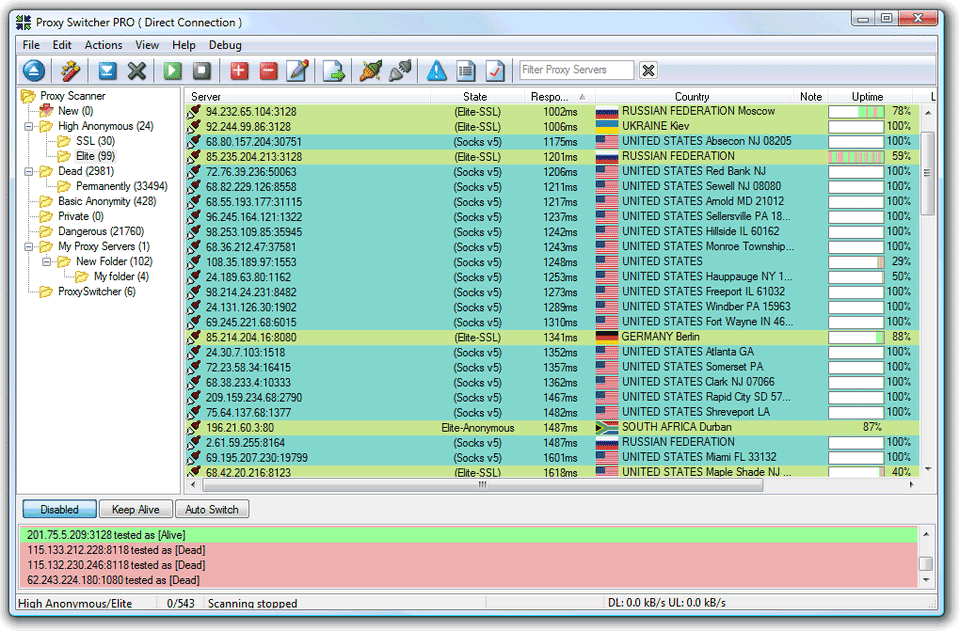

#ELITE PROXY SWITCHER 1.27 SERIAL FREE#

Must inform themselves about, and observe any restrictions relating to, the offering of the ADSs and the distribution of this prospectus or any free writing prospectus outside of the United States. Persons outside the United States who come into possession of this prospectus or any free writing prospectus Jurisdiction where action for that purpose is required, other than in the United States.

We nor any of the underwriters has done anything that would permit this offering or possession or distribution of this prospectus or any filed free writing prospectus in any The information contained in this prospectus is current only as of its date. This prospectus is an offer to sell only the ADSs offered hereby, and only underĬircumstances and in jurisdictions where it is lawful to do so. You must not rely on any unauthorized information or representations. To be delivered or made available to you. INDEX TO THE CONSOLIDATED FINANCIAL STATEMENTSĭealer, salesperson or other person is authorized to give any information or to represent anything not contained in this prospectus or in any free writing prospectus we may authorize

WHERE YOU CAN FIND ADDITIONAL INFORMATION MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OFĭESCRIPTION OF AMERICAN DEPOSITARY SHARES SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS Ordinary shares for a period of 180 days after the date of this prospectus, subject to certain exceptions. Each of the private placement investors has agreed not to, directly or indirectly, sell, transfer, or dispose of any Class A Securities Act of 1933, as amended, or the Securities Act. Securities and Exchange Commission, or the SEC, under Regulation S of

#ELITE PROXY SWITCHER 1.27 SERIAL REGISTRATION#

Shares to each investor is being made through private placement pursuant to an exemption from registration with the U.S. Our proposed issuance and sale of Class A ordinary The concurrent private placements areĮach at a price per share equal to the initial public offering price adjusted to reflect the ADS-to-Class A ordinary share ratio. Xing Wang, our director, and (iv) US$20.0 million by Kevin Sunny Holding Limited. (iii) US$30.0 million by Zijin Global Inc., an affiliate of Mr. (i) US$300.0 million by Inspired Elite Investments Limited, an affiliate of Meituan Dianping, (ii) US$30.0 million by Bytedance (HK) Limited, an affiliate of Bytedance Ltd., With, and subject to, the completion of this offering, certain existing shareholders have agreed to purchase US$380.0 million in Class A ordinary shares from us, including Share is entitled to ten votes, subject to certain conditions, and is convertible into one Class A ordinary share at any time by the holder thereof. Each Class A ordinary share is entitled to one vote, and is not convertible into Class B ordinary shares under any circumstances. Holders of Class A ordinary shares and Class B ordinary shares will have the same rights except for votingĪnd conversion rights. That the underwriters do not exercise their option to purchase additional ADSs. Shares and 73.0% of the aggregate voting power of our total issued and outstanding ordinary shares immediately after the completion of this offering and the concurrent private placements, assuming These Class B ordinary shares will constitute approximately 21.3% of our total issued and outstanding ordinary Mr. Xiang Li willīeneficially own all of our issued and outstanding Class B ordinary shares. The completion of this offering, our outstanding share capital will consist of Class A ordinary shares and Class B ordinary shares. Hold more than 50% of our aggregate voting power immediately upon the completion of this offering and the concurrent private placements. Mr. Xiang Li, our founder, chairman, and chief executive officer, will Upon the completion of this offeringĪnd the concurrent private placements, we will be a "controlled company" as defined under the Nasdaq Stock Market Rules. federal securities laws and are eligible for reduced public company reporting requirements. Our ADSs have been approved for listing on the Nasdaq Global Select MarketĪre an "emerging growth company" under applicable U.S. To this offering, there has been no public market for the ADSs or our Class A ordinary shares. Each ADS represents two of ourĬlass A ordinary shares, par value US$0.0001 per share. This is an initial public offering of 95,000,000 American depositary shares, or ADSs, by Li Auto Inc. Representing 190,000,000 Class A Ordinary Shares INDEX TO CONSOLIDATED FINANCIAL STATEMENTS

Use these links to rapidly review the document

0 kommentar(er)

0 kommentar(er)